About e-Invoice

- Electronic invoices are digital representations of transactions between suppliers and buyers.

- Electronic invoices replace paper or electronic documents such as invoices, credit notes and debit notes.

- Electronic invoices contain the same basic information as traditional documents, such as: detailed information of suppliers and buyers, project description, quantity, price excluding tax, tax and total amount, which records transaction data of daily business operations.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/08/未命名的设计-2.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/08/未命名的设计-2.png)

The Format of E-Invoice

E-Invoice is a document created in the format specified by the IRBM and can be processed automatically by the relevant system.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/08/未命名的设计-3.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/08/未命名的设计-3.png)

The Format of E-Invoice is NOT a

PDF, DOC, JPG, INVOICE, MAIL, ETC

The requirement of E-Invoice

• E-invoices cover typical transaction types such as B2B, B2C and B2G. For B2G transactions, the e-invoicing process is similar to B2B transactions.

• E-invoicing is applicable to all taxpayers engaged in business activities in Malaysia. This includes certain non-commercial transactions between businesses and individuals engaged in the provision of goods and services.

• As regards e-invoicing guidelines for certain non-commercial transactions between individual taxpayers, IRD will provide them in due course.

In certain business-to-consumer transactions, where the end consumer does not require an electronic invoice to support tax purposes, the supplier will be allowed to issue a plain receipt or invoice to the end consumer in accordance with the current practice adopted by the supplier.

End Consumer

Merchant

After a certain period or time limit, the supplier adds up the ordinary receipts or invoices issued to the end consumer and issues a Consolidated E-Invoice to support the transaction with the end consumer.

INCLUDING :

1. Association

2. Body of Persons

3. Branch

4. Business trust

5. Co-operative

6. Limited liability partnership

7. Partnership

8. Property trust found

10. Property trust

11. Real estate investment trust

12. Representive office and regional office

13. Trust fund

14. Unit trust

Target Taxpayer | Implementation Date |

Taxpayers with annual turnover or income exceeding RM100 million | 1 June 2024 |

Taxpayers with an annual turnover or income exceeding RM50 million but not exceeding RM100 million | 1 January 2025 |

Taxpayers with an annual turnover or income exceeding RM25 million but not exceeding RM50 million | 1 January 2026 |

All taxpayers and certain non-business transactions | 1 January 2027 |

• Taxpayers with audited financial statements: Based on annual turnover or income as set out in the audited financial statements for fiscal year 2022.

• Taxpayers with unaudited financial statements: calculated based on annual income reported on their tax return for the 2022 tax year.

• In the event of a change at the End of the fiscal Year 2022 (e.g., change of Year End), the taxpayer’s turnover or income will be adjusted to 12 months on a pro rata basis to determine the implementation date of the E-invoice.

To facilitate taxpayers’ transition to the era of e-invoicing, IRBM has developed two different E-invoice transmission mechanisms:

The MyInvois portal hosted by IRBM

Application Programming Interface (API)

Workflow of E-Invoice

1. Issuance of E-Invoice

When a sale or transaction is made (including e-Invoice adjustments), the supplier creates an e-Invoice and shares it to IRBM via Mylnvois Portal or API for validation.

2. Validation of E-Invoice

IRBM validates e-Invoices in real-time. After validation, suppliers get a Unique Identifier Number via Mylnvois Portal or API for traceability and preventing tampering.

3. Nofication of validated E-Invoice

IRBM will inform both the supplier and buyer once e-Invoice has been validated via Mylnvois Portal or APIs.

4. Sharing of E-Invoice

Upon validation, the supplier is obliged to share the cleared E-Invoice (embedded with a QR code) with the buyer.

The QR code can be used to validate the existence and status of the E-Invoice via IRBM’s official portal.

5. Rejection or cancellation of E-Invoice

Upon issuance of e-Invoice, a stipulated period of time is given to:

• Buyer to request for rejection of the e-Invoice

• Supplier to perform cancellation of e-Invoice

Rejection request or cancellation must be accompanied by justifications.

6. MyInvois Portal

Supplier and buyer will be able to obtain a summary of the e-Invoice transactions via Mylnvois Portal.

What is New in AutoCount Accounting 2.1

Intelligence Costing will be introduce to the new version of AutoCount Accounting that let the system auto calculate your item cost in the background. You no longer need to manually trigger the “Recalculate Stock Costing” function. This new function come with a new service which is the AutoCount Costing Service. You still can access the “Recalculate Stock Cating” by managing the access at the Stock Costing Option.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115328.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115328.png)

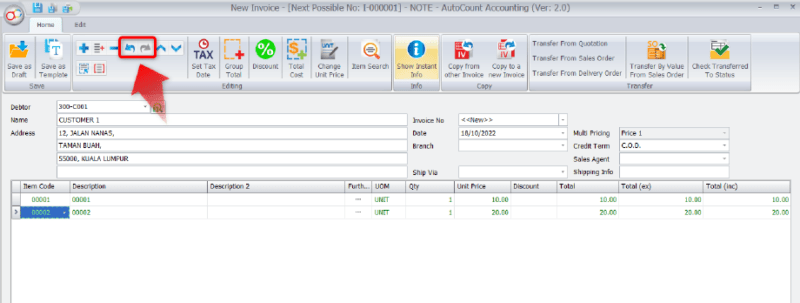

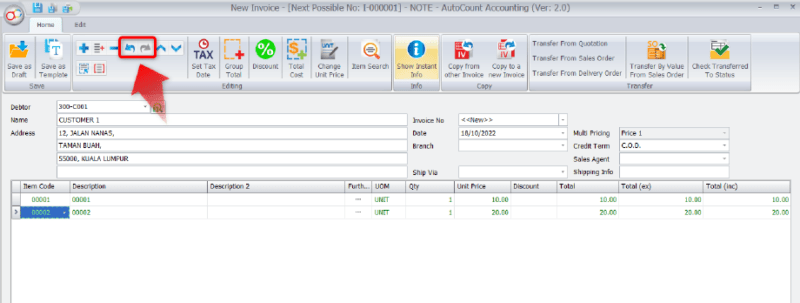

Wish to revert some mistake you made in data entry? Dont worry! The undo and redo function is here. You can now reverse your precious actions that you had made in AutoCount Accounting 2.1. Currently, this feature only allow in document entries only.

In the new version, the user maintainece is enchanced. Now there is a check box that use to show active user only. This is useful to filter out user if there are too many inactive users.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-120116-800x262.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-120116-800x262.png)

We added a footer that shows the total outstanding of all deposits records in Outstanding ARAP Deposit Report.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115427-792x400.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115427-792x400.png)

At the Purchase side, we add a new Purchase Consignment Movement Report that capture and process the data for Purchase Consignment.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115455-800x309.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115455-800x309.png)

A new access right will be introduce to control who had the access to add Batch No. This is use to control some user did not allow to edit Item Maintainece but able to create new Batch No from Purchase Side (Good Recieve Note/ Purchase Invoice)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115520-800x340.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115520-800x340.png)

Now you can change numbering format for Bank Slip. After adding a new numbering format, you can then select this different numbering format when you generate your Bank Slip.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115614-800x254.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115614-800x254.png)

A new option has been introduced in Stock Aging Report. This option is useful for those that wish to see their stock aging from the beginning when they recieve.

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115656-800x291.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Screenshot-2023-09-04-115656-800x291.png)

There is a new plugin that will be introduce in AutoCount Accounting 2.1 which is the E-Invoice Plugin. This plugin will convert your invoice to an E-Invoice format and send directly to the goverment. The details in the Invoice must be confirm before you convert it into E-Invoice.

- Support Save Layout Function at Easy Item

- Default Unchecks “Merge Detail” Checkbox During Transfer

- Reorder Advice Generate Purchase Order exclude 0 Order Qty Items

- Renamed “Remaining Amount” to Remaining Amount (Transfer by Value)” at Outstanding Sales Order Listing and Detail Listing

- Add Order Qty Column at stock Assembly Detail Listing

- Add Reason Column into Detail Listing Report

- Audit Trail to Record Detail on Saving Below Minimum Price or Higher Maximum Price

- Support New Kazakhstan (KZT) Currency

![[alt]](https://presoft.com.my/wp-content/uploads/2023/08/ac-accounting.webp)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/08/AutoCount-Accounting-Transparent-Background-1400x347.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/logo_Cloud_Payroll.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/3b1aad9d-1364-4342-9edd-bad3071d9cb5.webp)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/ea4149fc-b128-4f8f-bc78-b4d5cf8b5e39-1400x195.webp)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/logo_Accounting.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/logo_Cloud_Accounting.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/logo_POS.png)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Go-global-logo-2.webp)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/timetec-1-e1634283986939.webp)

![[alt]](https://presoft.com.my/wp-content/uploads/2023/09/Mobile-stock.webp)